Overview of compliance areas

To help navigate the different core areas of employer compliance, the following section summarizes important details and provides links to more information. You can also review the employment law section of Nonprofit Association of Washington’s Let’s Go Legal toolkit.

Click the plus sign for more information about each step.

Placeholder [hidden via css]

Anti-Discrimination, Anti-Harassment, and Anti-Retaliation

Most employers are subject to anti-discrimination laws like Title VII of the Civil Rights Act governed by the Equal Employment Opportunity Commission (federal) and the Washington State Law Against Discrimination governed by the Human Rights Commission (state). In Washington, under L&I, workers are also entitled to protection against safety and health, wage and hour, and some other types of workplace discrimination.

In 2018, the Washington State Legislature passed Senate Bill 6471, which required the Human Rights Commission to develop procedures, best practices, and a model sexual harassment policy.

While Washington is an at-will employment state, employers cannot fire or retaliate against an employee who exercises a protected right or files a compliant under certain employment laws. State law gives employees protection in the following areas: Minimum Wage Act, injured worker’s claims, safety complaints, discrimination in the workplace, protected leave, and Equal Pay and Opportunities Act.

For more information:

- Review the Human Rights Commission webpage on the Washington State Law Against Discrimination

- Review the Human Rights Commission webpage on Sex/Pregnancy in Employment for materials to assist in creating a workplace free from sexual harassment

- Review L&I’s webpage on Safety and Health Discrimination

- Review L&I’s webpage on Termination & Retaliation

Meals and Breaks

Under Washington law, workers have a right to take rest breaks and meal breaks. For every four hours worked, workers must be allowed a paid rest period (free from duties) of at least 10 minutes. When workers work more than five hours in a shift, they must be allowed a meal period of at least 30 minutes that starts between the second and fifth hour of the shift. Workers can waive their meal break requirement – only if both the worker and employer agree. Workers cannot waive rest break requirements. All workers must receive “reasonable access” to bathrooms and toilet facilities.

For more information:

- Review L&I’s webpage on Rest Breaks, Meal Periods & Schedules

- Review the Fair Labor Standards Act Break Time for Nursing Mothers

Overtime and Pay

Workers must be paid for all work performed and be paid an agreed-upon wage on a regular, scheduled payday (at least once per month). Workers can receive pay by check, cash, direct deposit, or even pre-paid payroll or debit cards, as long as there is no cost to the worker to access their wages. If a worker quits or is fired, the organization must provide their final paycheck on or before the next regularly scheduled payday.

An employer can only deduct money from a paycheck under certain conditions, and the rules vary for deductions from a final paycheck and deductions during on-going employment. There are mandatory paycheck deductions such as federal income taxes, Medicare, workers’ compensation, etc.

Most employees who work more than 40 hours in a 7-day workweek are entitled to overtime pay. Overtime pay must be at least 1.5 times the employee’s regular hourly rate. See below for more information on Washington Overtime Rules.

For more information:

- Review L&I’s webpages on Getting Paid and Overtime

Review L&I’s webpage on Payroll & Personnel Records

Protected Leaves

Workers have rights under the law that allow them to take time away from work that is safe from retaliation or discrimination from the employer – this is known as protected leave. Under protected leave, workers have the right to return to the same job and employment terms held before the leave. An employer cannot fire or otherwise retaliate against a worker for filing a complaint about possible violations for their protected leave rights.

For more information:

- Review L&I’s webpage on Protected Leave Complaints for a list of protected leaves allowed by the State of Washington

- Check out the Workers in Nonprofits – Leave Reference Guide for an overview of leave laws, what the laws mean, what agencies enforce each law, and based on the organization who is covered.

Safety and Health

Washington State safety and health law requires all employers to create a written Accident Prevention Program. For any workplace that has eight or more employees, you must have a Safety Bulletin Board. Also, employers must have a safety committee or safety meetings, depending on the size of the organization. There are also provisions for first aid and fire extinguishers including training.

For more information:

- Review the L&I Safety and Health Rules by specific chapter

- Review the Nonprofit Association of Washington Safety & Health in Nonprofits toolkit

Washington overtime rules

Washington Overtime Rules determine which employees can be considered overtime-exempt, meaning they are not required to be paid overtime for working more that 40 hours in a 7-day workweek or provided other protections under the Minimum Wage Act (like paid sick leave). Most overtime-exempt employees must meet a list of duties requirements and a minimum weekly salary amount, known as the minimum salary threshold. New state rules went into effect as of July 1, 2020 with a salary threshold schedule that will incrementally increase to 2.5 times the state minimum wage by 2028. Small employers (1-50 employees) have a more gradual phase-in schedule to give extra time to comply with the rules in comparison to large employers (51 or more employees).

If your nonprofit has exempt employees with salaries below the minimum salary threshold, there are options to consider.

- Convert salaried-exempt employees to salaried-nonexempt or hourly-nonexempt and pay any overtime accrued or limit hours to 40 hours per workweek

- Maintain as salaried-exempt employees by ensuring the workers meet the job duties test requirements and minimum salary threshold

Remember, you will have to revisit and keep pace as the minimum salary threshold rises annually through 2028.

Why did the State of Washington enact new overtime rules?

The federal overtime threshold has not changed since the 1970s. As a result, it has not kept up with the rate of inflation. Having a higher overtime threshold protects lower wage workers from exploitation. Nonprofits have the same obligation as for-profit employers do to be good employers. Although this requires change, it will result in better compensation and working conditions in the nonprofit sector overall, which will in turn increase equity and our ability to attract and retain the best talent at our organizations.

Planning across this multi-year implementation and preparing your nonprofit’s workers as well as your systems can be challenging. The following is a list of tools and resources to help you navigate the Washington Overtime Rules.

- Review L&I’s webpage on Changes to Overtime Rules

- With L&I’s Overtime Exempt Salary Budget Tool, determine if an individual employee’s salary meets the minimum salary threshold and estimate a budget for the overtime cost if the employee is classified as nonexempt

- With the Workers in Nonprofits Overtime Salary Threshold Tool, small employers can look at all their exempt employees at once across the implementation period and determine what salaries meet the minimum salary threshold as well as estimated expenses

For more information, watch the following Overtime Salary Threshold Tool Tutorial Video

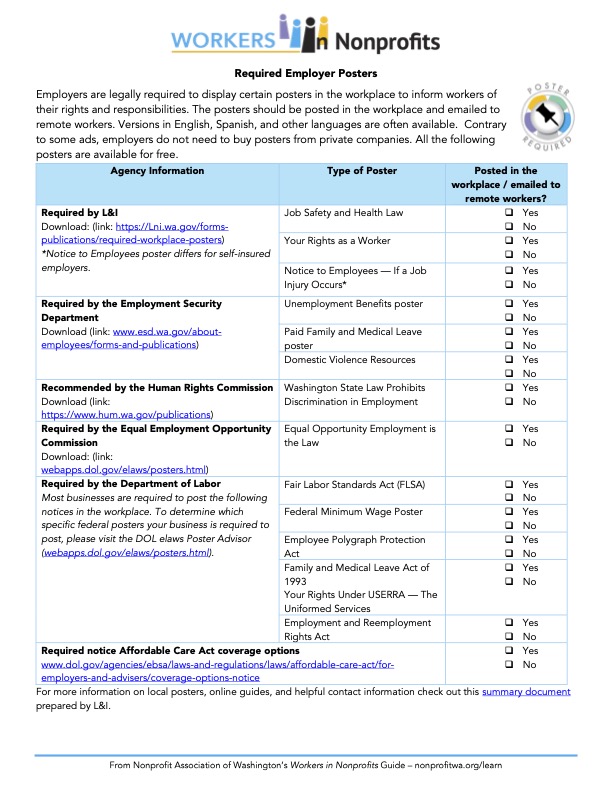

Required employer posters

Employers are legally required to display certain posters in the workplace to inform workers of their rights and responsibilities. The posters should be posted in the workplace and emailed to remote workers. Versions in English, Spanish, and other languages are often available. Contrary to some ads, employers do not need to buy posters from private companies. All the following posters are available for free.

Download

Download

Download

Download

Download

Most businesses are required to post the following notices in the workplace. To determine which specific federal posters your business is required to post, please visit the DOL elaws Poster Advisor

Download

Most businesses are required to post the following notices in the workplace. To determine which specific federal posters your business is required to post, please visit the DOL elaws Poster Advisor

Download

Most businesses are required to post the following notices in the workplace. To determine which specific federal posters your business is required to post, please visit the DOL elaws Poster Advisor

Download

Most businesses are required to post the following notices in the workplace. To determine which specific federal posters your business is required to post, please visit the DOL elaws Poster Advisor

Download

Most businesses are required to post the following notices in the workplace. To determine which specific federal posters your business is required to post, please visit the DOL elaws Poster Advisor

Download

Download

Your Rights Under USERRA — The Uniformed Services

Required Workplace Posters

A list of posters required for employers to post in the workplace

DownloadFor more information on local posters, online guides, and helpful contact information check out this summary document prepared by L&I.