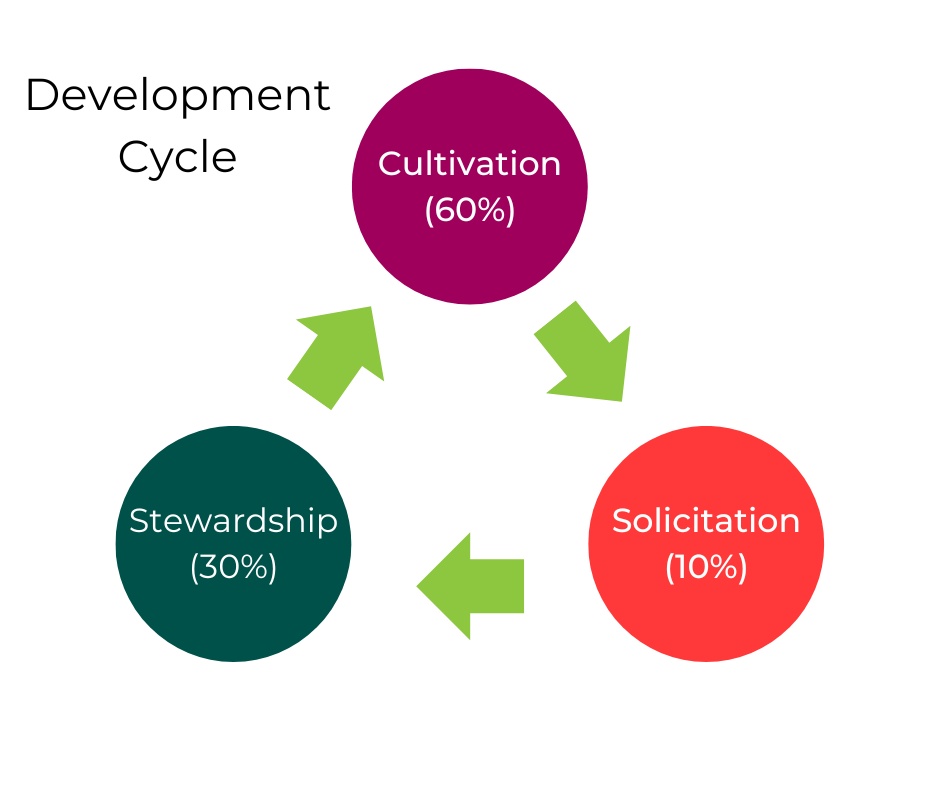

Guided by a plan or strategy that reflects budgetary and organizational goals, fundraising is a system of activities, events, and solicitations that require effort on multiple levels. There are many variations of development cycles presented in fundraising spaces, and each approach includes three major steps: cultivation, solicitation, and stewardship. Generally, in fundraising work, approximately 60% is cultivation (building relationships), 10% is solicitation (asking for gifts), and 30% is stewardship (managing gifts and relationships). Therefore, anchoring fund development by building relationships with current and potential donors is critical.

As a board, take time to discuss all the ways you can accomplish cultivation, solicitation, and stewardship in relation to your fundraising goals and the organization’s mission. Work with each board member to identify their comfort area(s) in the cycle. Based on each board member’s comfort area(s), develop an individualized plan for how they can best support the organization’s fundraising activities. Remember to celebrate successful fundraising in all forms as a positive addition to the budget and organization!

As you think about planning, the board needs to know what kind of solicitations the organization is making as well as understand their individual solicitation activities are part of a larger fundraising plan or strategy. Explore and discuss multiple ways in which board members can participate in fundraising. Also in your planning, review your nonprofit’s funding sources and discuss as a board if you feel there is currently adequate diversification to ensure organizational stability. When looking at funding sources, think about the consistency and reliability of the source as well.

To bring your fundraising plan to life, you need systems and policies in place across the organization to ensure fundraising happens in compliance with the law and best practices. Alignment of fundraising and financial reporting is essential for effective and timely information to reach individuals and institutions funding your nonprofit’s work. The IRS regulates the donor documentation requirements needed to claim a deduction as a charitable contribution, so having a system set up to process and acknowledge gifts properly is imperative.

As contributions come in from all your fundraising efforts, nonprofit accounting standards require organizations to classify contributed income in one of two ways: with donor restrictions and without donor restrictions. Reviewing financial statements monthly will help the board ensure a commitment to honor donor intent and comply with conditions and restrictions placed on donations.

Lastly, there may be times a nonprofit should not or may not want to accept a gift offered by a donor. Some gifts may create more difficulty or unanticipated expense than actual benefit for the organization. A nonprofit should consider adopting a gift acceptance policy that clearly states what types of gifts the organization will and will not accept. A gift acceptance policy helps manage donor expectations and provides direction to board members, staff, and volunteers who may support fundraising efforts. Check out this sample Gift Acceptance Policy from National Council of Nonprofits as an example.

Reflection...

Think about all the possible ways your organization brings in funds including support (e.g., donations, grants, and special events) and revenue (e.g., admissions, earned income, and return on investments). Here are some questions to ask yourself.

- Where does the organization’s funding come from now?

- What percentage of the budget does each funding source make up (e.g., 30% is from foundation grants)? Over the next few years, would you like the percentages to change in some way

- For funds with donor restrictions, do you know what the reporting and accounting requirements are? Is the organization following through on required reporting and complying with the funding conditions?