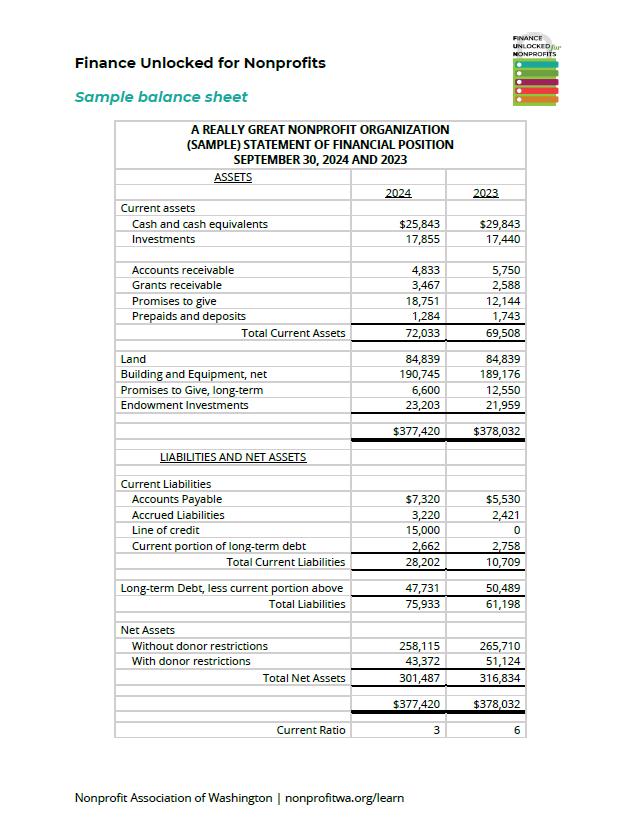

How the balance sheet is structured

The balance sheet is always arranged in the same order with assets at the top, followed by liabilities, and then net assets. This consistent format makes comparing financial reports easier.

ASSETS: What your organization owns or has the right to use.

- Assets are typically listed in order of liquidity, or how quickly you can turn the asset into cash.

- Cash and cash equivalents are available within three months.

- Current assets are those assets that can be converted into cash within 12 months.

LIABILITIES: What your organization owes to others.

- Current liabilities are those that are due within 12 months. This may include liabilities like accounts payable, accrued liabilities, and/or a current portion of long-term debt.

NET ASSETS: This is the difference between your total assets and total liabilities, effectively your organization’s net worth. Net assets also represent the total resources your organization has saved from prior years.

- Net assets are classified based on the presence of donor restrictions on their use. You may have both “without donor restrictions” and “with donor restrictions.”

As you review the balance sheet, focus on the relationship between current assets and current liabilities. Looking at this relationship helps you determine whether your organization has enough resources available to pay its obligations over the next 12 months. If you notice the current liabilities getting close to or exceeding the current assets, this is an indicator that immediate action is needed.

With an understanding of your nonprofit’s current assets and current liabilities, you can calculate the current ratio, which is a measure of liquidity. Acceptable current ratios vary but generally should be 1.5 or greater for financially stable organizations. If the current ratio is below one, the organization may have problems meeting short-term obligations.

Putting the “balance” in balance sheet

There is a simple formula to help you think about the relationship between assets, liabilities, and net assets. This formula follows the typical balance sheet format.

ASSETS – LIABILITIES = NET ASSETS

You may prefer to think about the relationship as:

TOTAL ASSETS = LIABILITIES (Assets that are owed to others) + NET ASSETS (Assets that are yours)

Both formulas provide an easy way to remember this relationship!

Sample balance sheet

Check out this sample balance sheet as an example of the format.