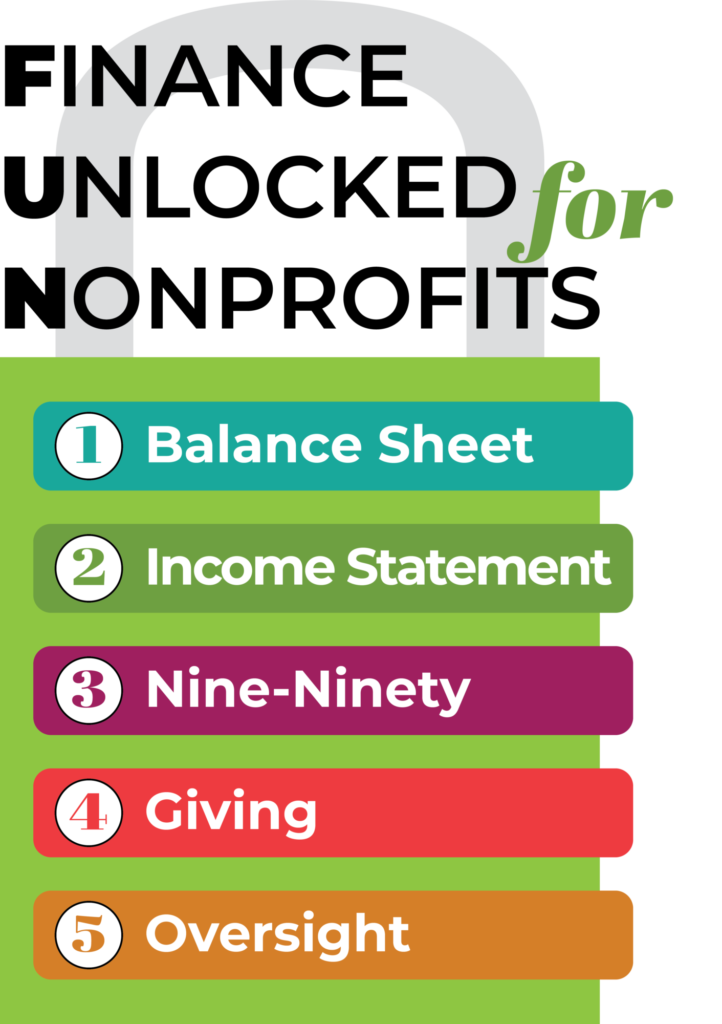

Finance Unlocked for Nonprofits, which intentionally abbreviates to FUN, was created to bring fun to finance. Each board member has their own personal experiences with finance that may range from excitement to mixed feelings to uneasiness. The feelings and perceptions you may carry shape how you approach your relationship to nonprofit finance. Approaching nonprofit finance in a welcoming way, Finance Unlocked for Nonprofits (FUN) aims to help unlock your financial literacy.

Upcoming Finance Unlocked Events

Finance Unlocked For Nonprofits Guide

Start by downloading the Finance Unlocked for Nonprofits guide that includes practice activities, worksheets, and reflection questions. As you work through the guide, watch the video for each chapter. Find templates and other documents to help put what you learned into practice in the document vault. Keep on learning with other resources and upcoming workshops on nonprofit finance.

Download the GuideWhat We Cover in Finance Unlocked for Nonprofits

Introduction

Start by learning why nonprofit finance matters. You will get an overview of the content covered in the subsequent 5 chapters.

Balance Sheet

At any given time, a nonprofit needs to know where they stand financially. A balance sheet is a report that shows an organization’s financial standing at a point in time. Having a solid understanding of your nonprofit’s finances at any given time supports decision-making and planning.

Income Statement

Nonprofits plan for the future and then regularly check reality against this plan. An income statement is a financial report showing operating results over a specific time period. This financial report provides an opportunity to examine the actual income and expenses in comparison to the planned budget.

Nine-Ninety (IRS Form 990)

A nonprofit’s most public document is their IRS Form 990. The Form 990 is readily available on the internet to any member of the public for review including potential funders. A properly filed form can show how your organization is operated, how it is compliant with applicable tax laws, how it is governed and managed, as well as highlight program accomplishments.

Giving

Financially stable nonprofits make use of a wide range of funding sources and are mindful of the differences in accounting, donor and funder expectations, and restrictions. Nonprofits need to think about the money that fuels their work including stewarding funds in ways that uphold the public’s trust.

Oversight

The policies and procedures designed to prevent fraud and ensure accurate reporting ground an organization’s financial oversight. Nonprofit board members are ultimately responsible for the effective, responsible use of a nonprofit’s resources. Strong oversight practices are critical to the integrity and success of an organization.

Document Vault

We’ve collected valuable resources, tools, and links for you and your organization in our Finance Unlocked for Nonprofits document vault.

Board Booklet

Budget Template

Chapter: 990 – Guide

Chapter: 990 – Video Transcript

Chapter: Balance Sheet – Guide

Chapter: Balance Sheet – Video Transcript

More Resources

National Council of Nonprofits

Continue Learning

Tax Basics for Nonprofits: 5 Things to Know

Download the Tax Basics for Nonprofits guide to learn 5 things that you should know about taxes for nonprofits.

View the Tax Basics Guide