Nonprofits are talking about the difficulty adjusting to the state requirement that employees under a rising salary threshold must be paid overtime for any hours work beyond 40 in any single workweek. After a long period of this minimum threshold being held steady even though the minimum wage and cost of living were rising, our state decided to take action to protect low-wage workers. Prior to the change, it was possible to be an exempt worker making a salary so low that if you worked extra hours beyond the customary 40 per week, your hourly pay might equate to less than minimum wage.

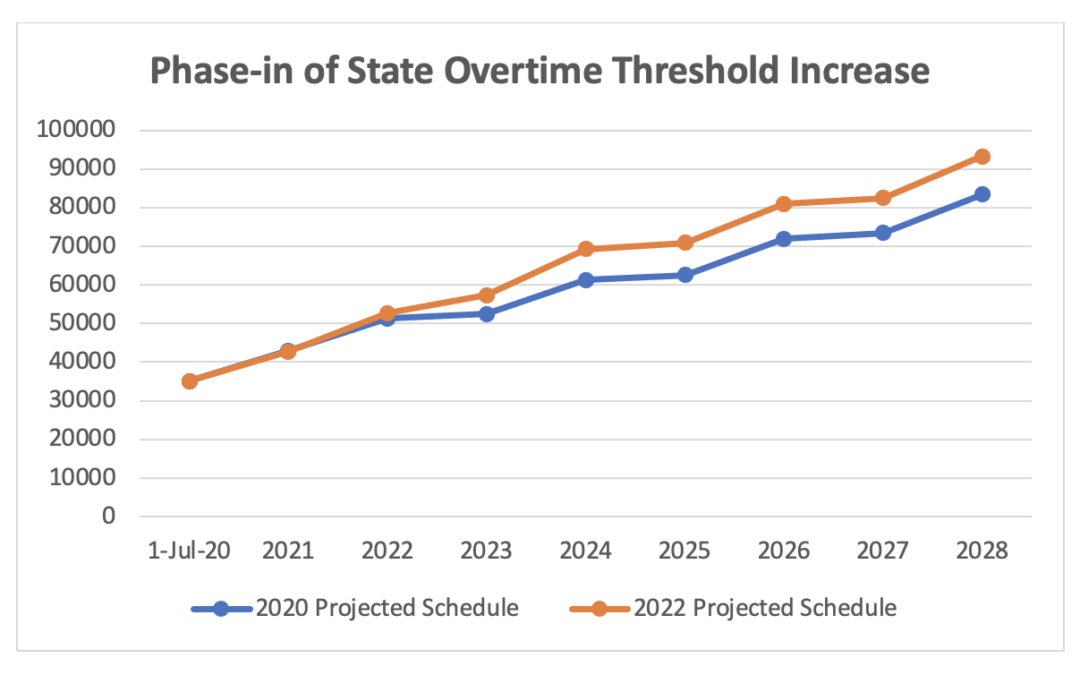

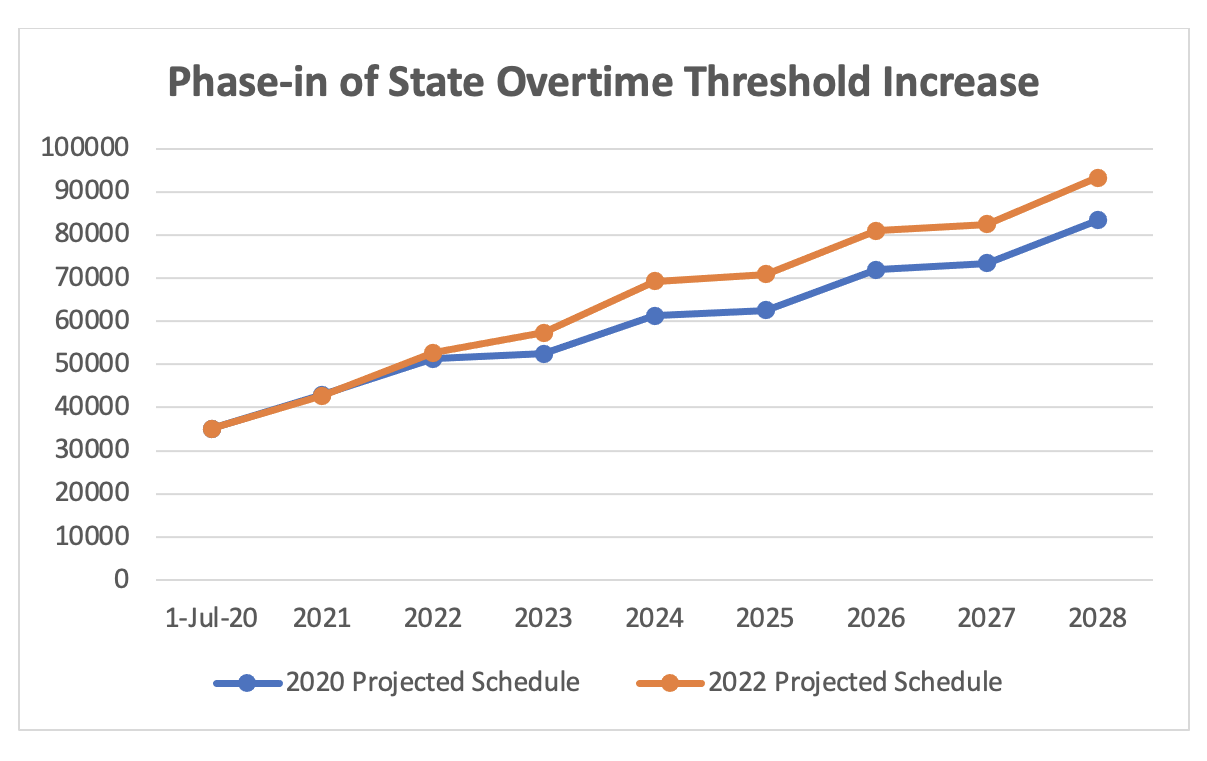

The Department of Labor & Industries established a plan to raise the threshold substantially to 2.5 times the minimum wage. Since this is a big change, the Department of Labor & Industries adopted a phase-in of the new threshold. NAWA’s advocacy was influential in extending the phase-in from six to eight years to give nonprofits more time to adjust. However, the phase in, which raises the rate significantly each January, has been rising more aggressively than originally projected because the threshold is a multiplier of the current minimum wage. Washington’s minimum wage is indexed to the Consumer Price Index and raises with inflation. The chart below shows L&I’s original prediction of how the threshold would rise compared with current projections.

What do nonprofit employers need to do to comply with the changes?

All staff being paid less than the current threshold—regardless of their duties—are overtime-eligible. As an employer, you need to implement a timesheet system to track non-exempt workers’ time and ensure that any hours over 40 in a single week are paid at time and a half. There is no flexibility in the rules to allow for staff members to work more one week and receive compensatory time off the following week. You may wish to consider whether it is more financially beneficial for your organization to raise the salaries of managers near the threshold so that they can remain exempt from overtime, or to establish a pool of money to pay overtime. We have an Overtime Salary Threshold Tool to help you determine your best option. Just remember, the threshold will go up again on January 1, 2024, so maintaining workers on the cusp as exempt may be a temporary solution.

It is important to acknowledge many nonprofits have a culture of overwork. Employees should be fairly compensated for their labor. If currently salaried exempt employees are regularly working more than 40-hour work weeks and they are re-classified as hourly, non-exempt staff, the employer needs to develop a plan for reducing their workload or paying overtime.

Is there a way to slow down the changes?

Many nonprofits are struggling to implement the changes. While we all would like to improve compensation for our workers, funders are generally not keeping up by increasing their funding levels each year. NAWA works to educate funders – including government partners – regarding the impact of flat funding on nonprofits. When the pandemic started, NAWA advocated to slow the phase-in, but we were unsuccessful in influencing the process.

What can we do?

Ultimately, low wages for nonprofit workers is a far bigger concern for the nonprofit sector. The practice of undervaluing and underpaying nonprofit professionals needs to stop. So, NAWA is focusing our efforts on advocating for improved funding to support wage increases and on encouraging employment practices that align with our shared values of fairness, caring for people, and creating thriving communities.

We believe that there’s a better way forward, where we have enough money to pay our staff competitive wages for a reasonable number of hours, where folks can do the work they love, and still have enough money to take care of their family. We invite you to stand with us to demand that nonprofits be fully funded, that our communities be resourced, and that our nonprofit community has what it needs to thrive. Learn more during day two of the Washington State Nonprofit Conference at our Advocacy Summit on Nonprofit Compensation.