Getting your worker opportunities sorted into the correct job classifications, developing effective job descriptions, and processing job applications can be daunting. In the following sections, we cover important information on these three topics along with providing resources to help you navigate.

Job Classifications

As you think about worker opportunities, you may have questions about what qualifies as a volunteer, intern, employee, or independent contractor. It is important to properly identify the type of worker. For example, misclassifying employees as independent contractors can expose an employer to liabilities from unpaid minimum wages and overtime pay to federal, state, and local tax withholdings. This Non-Employee Worker Summary Resource highlights items you need to know, questions to reflect on your practices, and information to grow your understanding of working with non-employees.

If you are recruiting a worker for a paid employee position, you will need to determine if the employee is classified as exempt or nonexempt. All employees are assumed to be covered by the federal Fair Labor Standards Act (nonexempt employees) and Minimum Wage Act unless they meet a list of job duties requirements and a minimum salary threshold (exempt employees).

This Job Classification and Overtime Summary Resource highlights items you need to know, questions to reflect on your practices, and information to grow your understanding of classifying employees.

Grow...

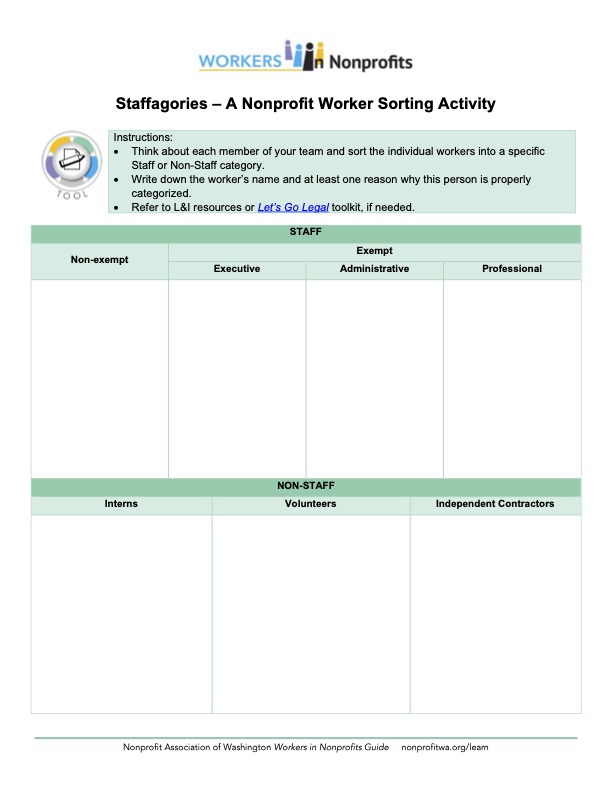

Job classifications can be confusing. Fortunately, L&I has informative resources to help you better understand different classifications of workers. Explore the following resources from L&I, and then complete the Staffagories activity sheet. The Staffagories activity was originally created by Nonprofit Association of Washington and Communities Rise (formerly Wayfind) as part of the Let’s Go Legal toolkit, which includes information on employment law.

Staffagories – A Nonprofit Worker Sorting Activity

Instructions:

- Think about each member of your team and sort the individual workers into a specific Staff or Non-Staff category.

- Write down the worker’s name and at least one reason why this person is properly categorized.

Refer to the L&I resources or Let’s Go Legal toolkit (linked above), if needed.

Job Descriptions

Job descriptions are a key piece of the recruitment process. Crafting an effective job description can attract a wide range of qualified candidates and ensure great candidates are not self-selecting out before even applying. A job description should paint a general picture of the role available, needed skills, knowledge, and experiences, and share details specific to your nonprofit’s mission, values, and culture.

The Washington Equal Pay and Opportunities act requires the salary range or wage scale, general description of benefits, and general description of other compensation in job postings. Employers must provide an employee who is offered an internal transfer or promotion with the wage scale or salary range of their new position, upon request by the employee. Employers with fewer than 15 employees do not have to meet these salary and wage disclosure requirements.

Job Applications

On the job announcement, be sure to let interested candidates know how to apply for the job opportunity. Sometimes you may want candidates to submit a formal job application on a form you provide requesting relevant information such as: basic contact information and work history. Other times, you may request that applicants submit a cover letter, a resume, and even sample pieces of work. The kind of application process you use may vary based on the size of your organization, type of worker you are hiring, and type of work the worker will do. Consider including flexible closing dates in job postings with priority given to applicants who submit their applications by a specific date. This is helpful if you are not successful in securing your first-choice applicant.

Most employers with 15 or more employees are subject to anti-discrimination laws governed by the Equal Employment Opportunity Commission (EEOC). Anti-discrimination laws make it illegal to discriminate against a job applicant or employee based on race, color, creed, religion, sex (including pregnancy-related discrimination), national origin, age, disability, genetic information, and military or veteran status. Washington’s anti-discrimination laws apply to employers with eight or more employees and protect the same characteristics as federal law and also extend protections based on veteran and marital status, sexual orientation, and political activities. Employers need to ensure there is no discrimination across all types of work situations – hiring, firing, promotions, harassment, training, wages, and benefits. To do this, on a voluntary basis, employers should collect and analyze basic demographic information from applicants and employees.

Anti-Discrimination Laws

Washington Equal Pay and Opportunities Act (EPOA)

The Equal Pay and Opportunities Act (RCW 49.58) prohibits gender pay discrimination and promotes fairness among workers by addressing business policies and practices that contribute to income disparities between genders. Both employees and job applicants have rights under this law.

For employees, the EPOA has provisions for equal pay, equal career advancement opportunities, open wage discussions, wage and salary range disclosure, and retaliation protections. For job applicants, the EPOA has provisions for wage and salary history privacy as well as wage and salary range disclosure. Beginning January 1, 2023, most employers (with 15 or more employees) must disclose in each posting for each job opening the wage scale or salary range, and a general description of all benefits and other compensation to be offered to the hired applicant (RCW 49.58.110). This Washington Equal Pay and Opportunities Act Summary Resource highlights items you need to know, questions to reflect on your practices, and information to grow your understanding of classifying employees. You can learn more by visiting http://www.Lni.wa.gov/EqualPay or calling 1-888-219-7321.

Did you know that the Washington State Department of Labor & Industries offers free customized consultations to help employers understand the possible effects of the EPOA on their organization and employment practices? To request a consultation please fill out a consultation request form.