As a nonprofit board member, you should understand the following Form 990 concepts.

- The Form 990 is your organization’s most public financial document and can be viewed by any member of the public.

- The Form 990 can be a useful marketing tool to share your organization’s mission, program accomplishments, successes, and stability.

- Governance and policy best practices are listed in the Form 990. For the Form 990, governance relates to maintaining your organization’s tax-exempt purpose, board independence, and certain written policies and procedures.

- Although a nonprofit may not pay federal income taxes, annual reporting through the Form 990 is mandatory to maintain tax-exempt status. If the Form 990 is not filed on time, is incomplete, or is not filed correctly, there are several legal and financial penalties that can fall on the organization. In addition, if the Form 990 is not filed for three consecutive years, the organization will automatically lose its federal tax exemption.

There are Form 990-related actions you can take to instill a strong nonprofit finance culture within your organization.

- Identify steps your nonprofit can take to strengthen current governance practices. Review all levels of compliance for your organization, and remember you can use Part VI Governance, Management, and Disclosure of the Form 990 as a guide for your assessment. Also, determine your organization’s state and local filing requirements.

- Assess your total support to determine year-to-year if your percentage of public support is declining, increasing, or holding steady. Make goals around the percentage of public support that would make your organization more sustainable over time.

- Review your gross income from unrelated business sources. If your organization has $1,000 or more of gross income from these sources, you must file a Form 990-T. Assess whether these activities pull away from your mission and primary services.

- Invite your communications, marketing, or development staff to review the Form 990 and provide wording that may resonate with potential donors and funders.

- As you consider how your organization may advocate on behalf of your mission, start by determining how much of your budget comes from public funds. Organizations cannot use federal funds or resources to influence state or federal legislation, while discretionary funds can be used.

Reflect...

Review your organization’s most recent Form 990. Here are some questions to ask yourself. Consider asking these questions across several board meetings to see how your answers change over time.

Filing:

- Of the formats available (Form 990-N, Form 990-EZ, or Form 990), which does your nonprofit need to file?

- By what date does your organization need to file?

- Who is responsible for ensuring you meet the filing deadline?

Compliance:

- Is your organization doing everything required to maintain tax-exempt status?

- Is your organization completing applicable state and local filing requirements?

Governance:

- When it comes to governance, policies, and disclosure, is your organization following best practices? Are there any items your organization should take action on within the next year?

Marketing:

- After reading your Form 990, what impressions would a potential donor or funder have about your nonprofit? Are these the impressions you want to convey, why or why not?

- Has your nonprofit done a good job of showing the program accomplishments and impact of the funds received?

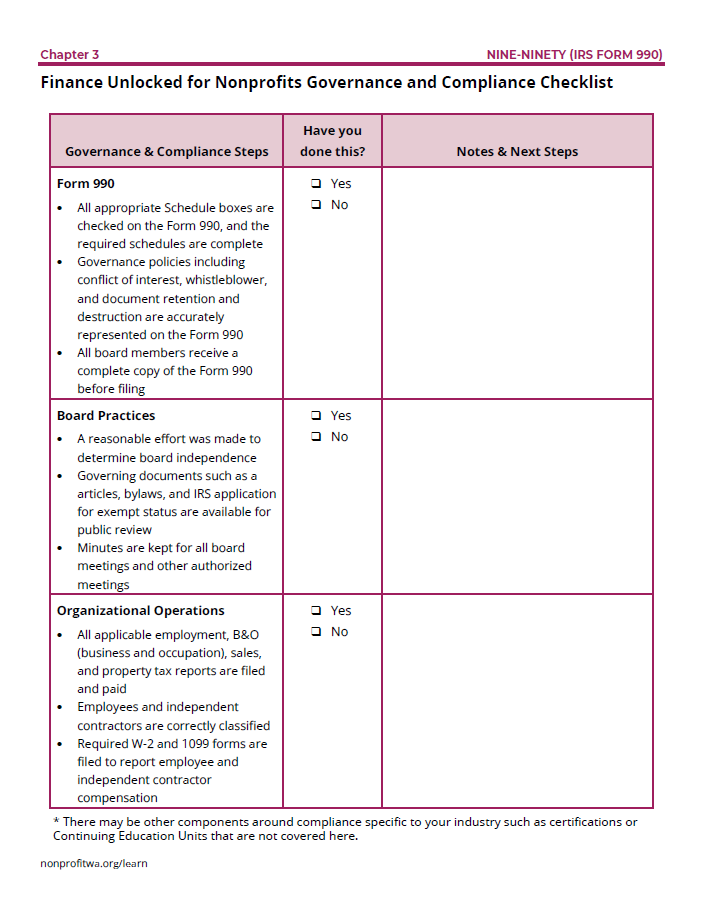

Maintaining strong governance and compliance practices is essential for your nonprofit. To help you assess a few more key items, the following worksheet outlines steps for your organization to review.

Governance and Compliance Checklist

This brief checklist reviews items to help your organization stay legally compliant with your finances.

Download