Washington State Gambling Commission changed its fee structure in July 2018. This will impact nonprofits who apply for gambling licenses for raffles or other activities.

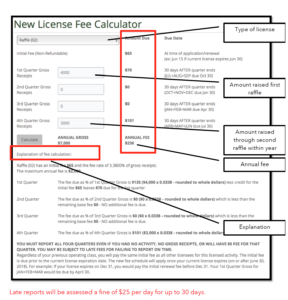

When you get a new license, or renew your license after July 2018, you will pay (1) an annual base license fee amount and then (2) additional license fees based on quarterly gross gambling receipts. Each quarter you may have additional license fees based on a percentage of your gross receipts. Your total yearly license fees will be based on your gambling gross receipts collected and reported each quarter. The expiration of your current gambling license will determine when you enter the new fee structure process.

When you get a new license, or renew your license after July 2018, you will pay (1) an annual base license fee amount and then (2) additional license fees based on quarterly gross gambling receipts. Each quarter you may have additional license fees based on a percentage of your gross receipts. Your total yearly license fees will be based on your gambling gross receipts collected and reported each quarter. The expiration of your current gambling license will determine when you enter the new fee structure process.

We strongly encourage you to use the WSGC New License Fee Calculator. It will tell you what you will owe, when, and why. We included an annotation of how it works in our revised Liquor, Cannabis, Gambling and Your Fundraising Event toolkit. Jump over to our learning website to download the toolkit and watch the video.