Nonprofits should have a set of core organizational policies and procedures that are followed. Your written financial procedures highlight the organization’s key internal controls, including who has access to what and when, and these documents should be made available to board members. Policies and procedures should be revisited at least annually to stay current and effective.

Procedurally, bank statements should be opened or viewed online by someone who understands the nonprofit’s work and has no role in the financial operations. Reviewing bank statements is meant to identify any transactions, payees, check signers, etc. that appear out of the ordinary. If the reviewer identifies something out of the ordinary, the individual should inform the full board.

When considering expenditures, create clear policies and procedures to help someone spending money on behalf of the nonprofit understand their limits and reporting process. Check that set limits are followed and expenses are documented appropriately for your organization’s process.

As you think about oversight, a whistleblower policy is critical. A whistleblower policy provides individuals a clear way to notify the board if something is suspicious, does not look or feel right, or may be detrimental to the organization.

Topics Covered

Reflect...

Review your organization’s financial policies and procedures. Here are some questions to ask yourself. Consider asking these questions across several board meetings to see how your answers change over time.

- Does your organization have basic, written accounting procedures that highlight key internal controls?

- Given your nonprofit’s size, have you limited access as much as possible? Does the organization have checks and balances for financial accountability?

- Thinking about your nonprofit’s current policies and procedures, what other policies might you need to implement? Are the policies and procedures up-to-date and effective?

- Reexamine Part VI Governance, Management, & Disclosure of the Form 990. Are there any best practices or policies your nonprofit should consider implementing?

Separation of Duties

Separation of duties is a practice by which no one person has sole control over the lifespan of a financial transaction. This means no one person should be able to initiate, approve, record, and reconcile a transaction. Through clear separation of duties, unintentional or intentional mistakes that may occur should be discovered by another person(s).

What does separation of duties look like, especially in small nonprofits? At minimum, two people are involved in financial functions and tasks are divided for items like bookkeeping, check writing and signing, and bank statement review. A stronger practice is to have at least three people involved. In both cases, the full board is involved by regularly receiving and reviewing financial reports to make sure actual expenditures align with the board approved budget.

The ability to demonstrate the separation of duties to an outside party is important. Documenting processes and including who has authority is a helpful step in demonstrating an organization’s internal controls have adequate separation of duties.

Sample Separation of Duties

Two-Person Separation of Duties

Three-Person Separation of Duties

The following worksheet has sample separation of duties for two- and three-people approaches, which include a few examples of possible tasks, and blank space for you to map out duties at your organization. Your organization may have additional financial tasks to complete.

Separation of Duties Worksheet

Use this worksheet to map out separation of financial duties at your organization.

DownloadOversight Checklist

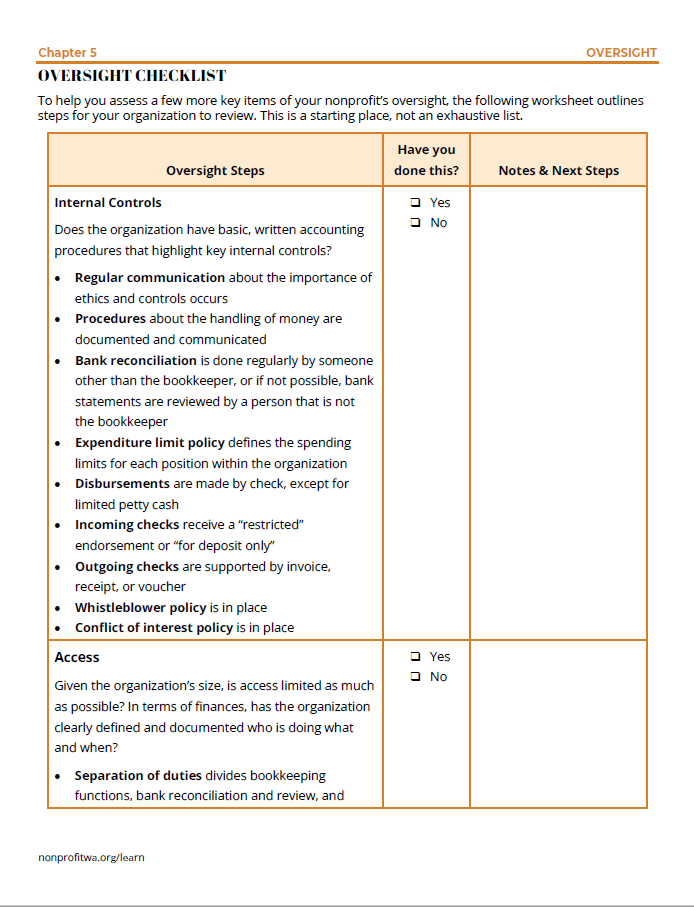

To help you assess a few more key items of your nonprofit’s oversight, the following worksheet outlines steps for your organization to review. There may be other areas around internal controls, access, and reporting your nonprofit wants to assess – this as a starting place.

Oversight Checklist

Use this checklist to assess areas of financial oversight in your organization.

Download