Download the Employment Law Legal Checklist and identify action items for your organization.

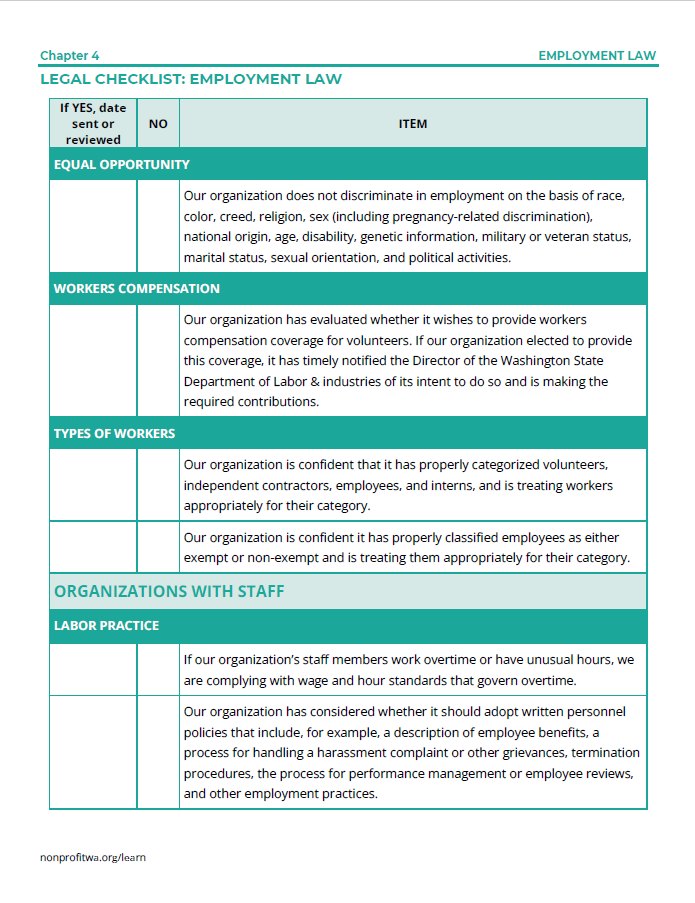

Legal Checklist: Employment Law

Download

Summary...

- Federal, state, and in some cases local law regulates employers’ pay practices and policies. Washington employers must comply with federal, state, and local law.

- Employers should understand the basis for at-will employment. Employers must also verify the work eligibility of employees with a Form I-9.

- Nonprofits need to make sure non-employees, such as interns, volunteers, and independent contractors, are treated consistent with the law to avoid incurring liability.

- Employees must be paid at least once a month on a regularly scheduled payday. Payroll taxes must be withheld and paid to the IRS. The IRS is very strict on payroll taxes and will hold individual board members liable for unpaid payroll taxes.

- Federal and state law prohibit discrimination across a wide array of characteristics.

Here are some questions to think about...

- Do the workers at your nonprofit reflect the people you serve or the people most affected by the issues your organization is working to address?

- Do you thoroughly review the job duties of worker opportunities to ensure they are properly classified? For current workers, do you reassess their job classifications when their job duties or wages change to verify they are still classified correctly?

Next steps...

- Go deeper into nonprofit employment and lifecycle of workers with Nonprofit Association of Washington’s Workers in Nonprofits Toolkit. Explore the guide and download useful resources and tools, including the Overtime Salary Threshold tool.

- Learn more about independent contractors through the following resources from the Washington State Department of Labor & Industries.

Chapter Materials

Start by downloading the Let's Go Legal guide that includes checklists, activities, and reflection questions. As ...

Download this chapter's guide before watching the video.

Transcript with visual descriptions of the Let's Go Legal Employment Law video

Overtime Salary Threshold Tool from Nonprofit Association of Washington

Check out this tutorial video on how to ...

Sample Whistleblower Policy from Charity Review Council

Two sample anti-discrimination policies

Two Sample at-will employment policies

Sample Confidentiality Agreement from National Council of Nonprofits

An activity to sort your workers into their proper classifications.