A nonprofit’s financial management practices are critical to the organization’s ability to achieve its mission and protect its assets. Providing financial training opportunities for the board and facilitating regular conversations related to financial literacy is an important step in fulfilling these crucial responsibilities.

The board should regularly review the balance sheet and income statement as well as a cash flow statement, if possible. The board should contribute to the budget development, understand budget components, and approve the budget annually. The board is responsible for ensuring the organization has a sustainable financial plan that includes the right balance of income streams and is not overly dependent on a single funding source. Board members also need to monitor funds with donor restrictions to make certain funds are spent and reported on as directed.

Annually, the board should review policies and procedures related to the separation of duties and internal financial controls. The proper separation of duties divides bookkeeping functions, reconciliation and review, and check writing and check signing across at least two people. The review process should ensure no one person can initiate, approve, record, and reconcile a transaction.

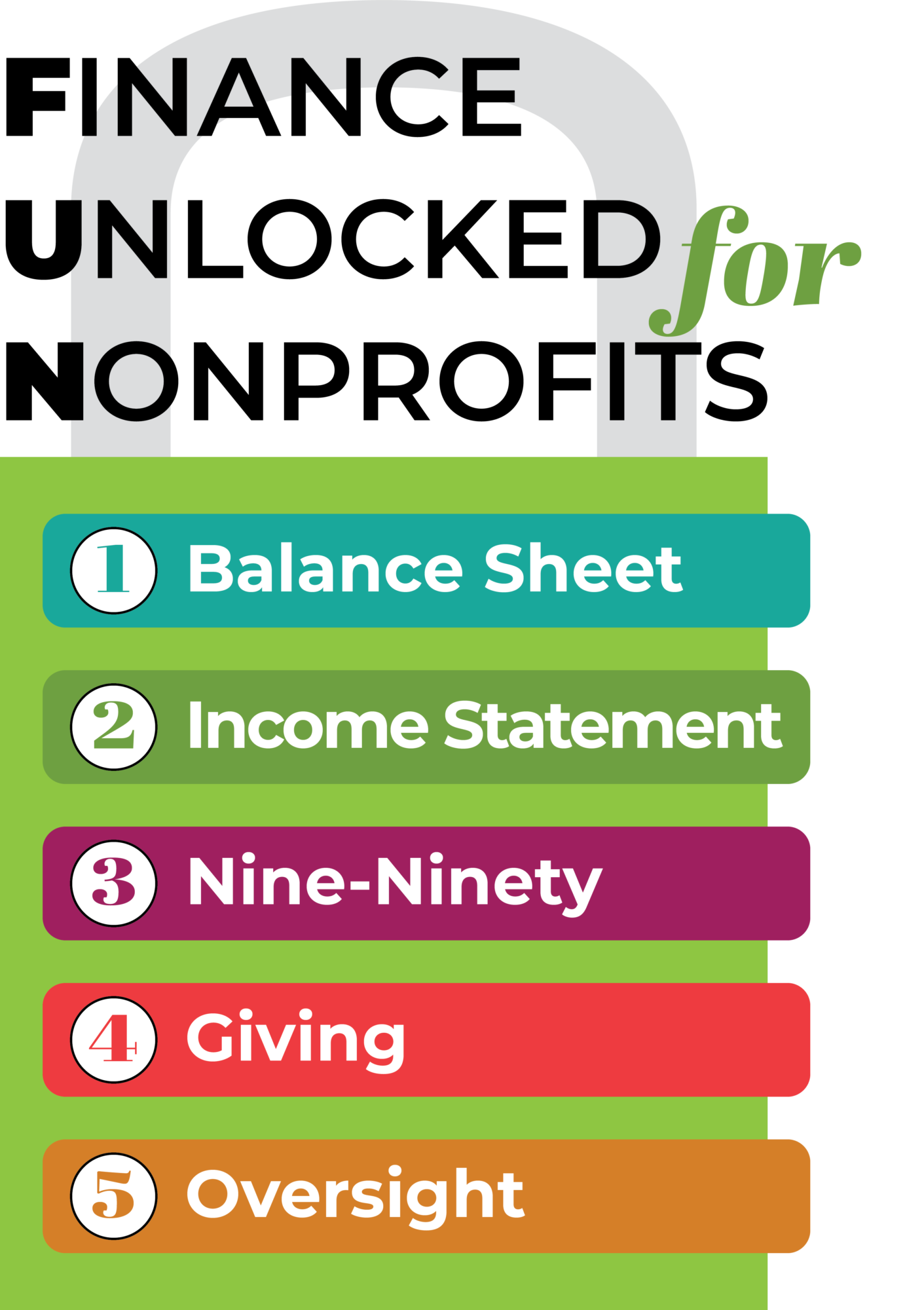

Finance Unlocked for Nonprofits

Learn more about a board’s financial duties in Nonprofit Association of Washington’s Finance Unlocked for Nonprofits Toolkit.