Making public key information about tax-exempt organizations through annual Form 990 filing and public disclosure about organizational activities can highlight how a nonprofit is operated, how it is compliant with applicable tax laws, and how it is governed and managed.

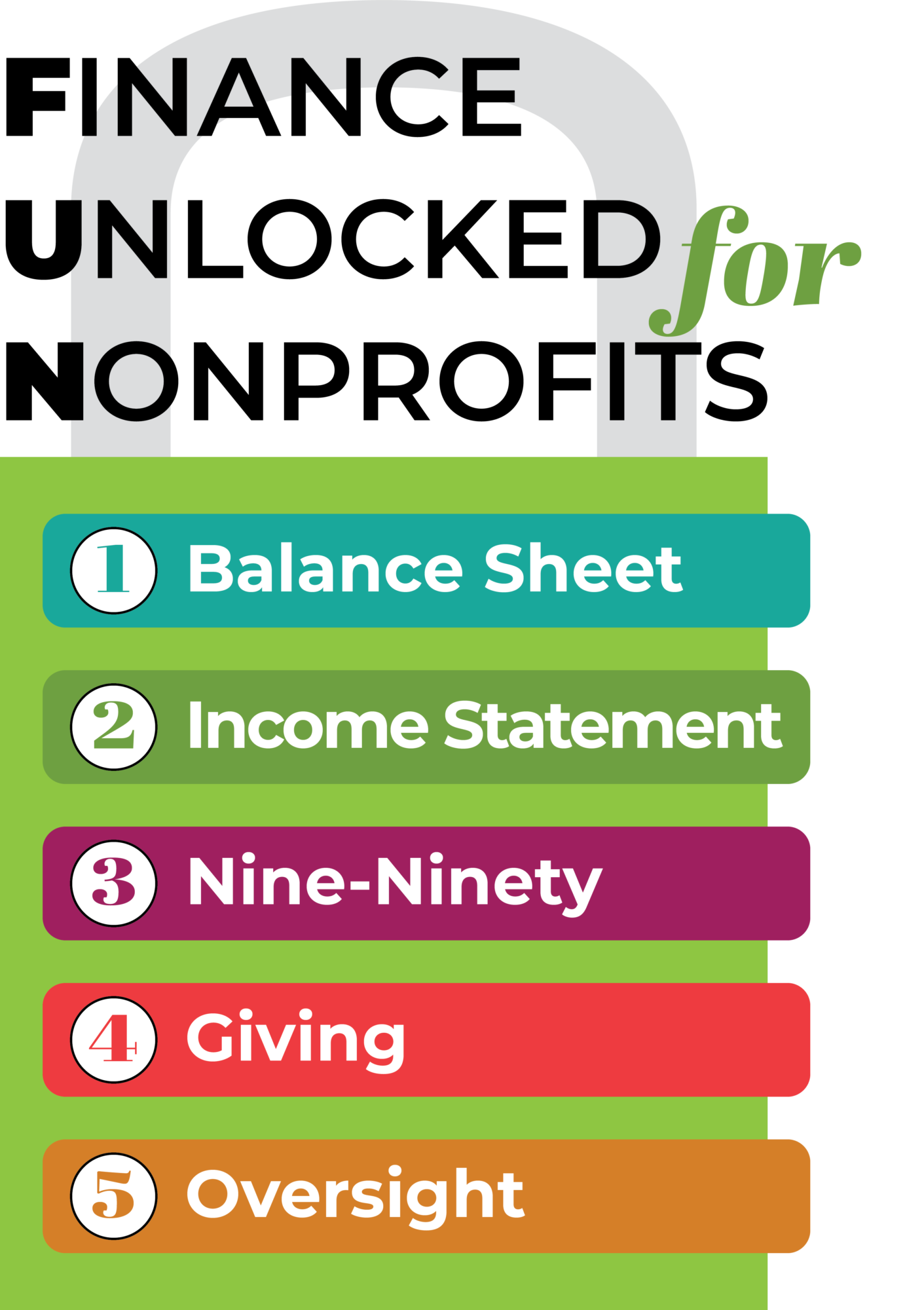

Topics covered:

Annual filing

Each year tax-exempt organizations must file an IRS Form 990, or one of its variations, by the 15th day of the 5th month after the organization’s accounting period ends (i.e., for a calendar-year filer, submit the Form 990 by May 15th). There are several Form 990 formats available depending on your nonprofit’s annual gross receipts and assets.

There are financial penalties for filing the Form 990 late. If an organization fails to file a Form 990 for three consecutive years, its tax-exempt status will be automatically revoked.

Nonprofit Association of Washington’s Finance Unlocked for Nonprofits Toolkit has an entire chapter on the Form 990, which includes a quick review section, a short worksheet, and questions to help you get more acquainted with your organizations Form 990.

Public Disclosure

It is considered to be in the public’s best interest that tax-exempt organizations make public key information about their activities. Specifically, a tax-exempt organization must make available for public inspection its:

- Application for tax exemption, which is either Form 1023 or Form 1024 depending on the organization.

- Annual return, which includes Form 990 and its variations for the prior three years.

It is not required to disclose the name and address of any contributor.